Silver Price Libya

(Libyan Dinar)

Conversion : 1 troy ounce = 31.1034768 grams

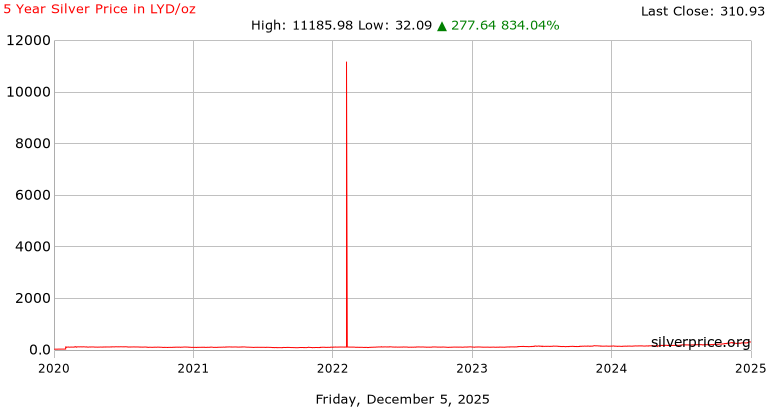

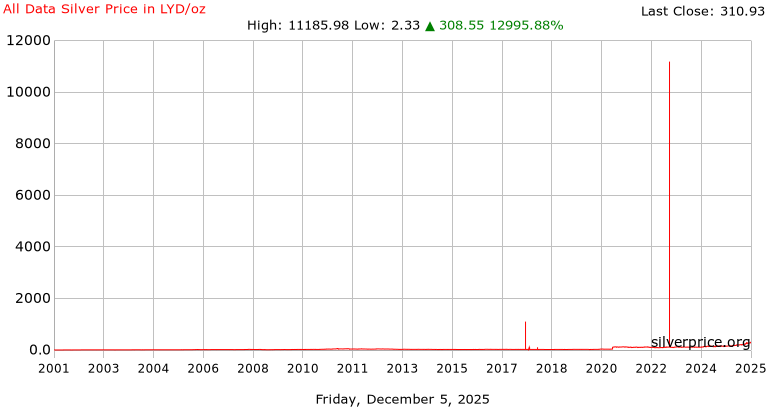

Libyan Dinar 24 Hour Spot Silver Price

Libyan Dinar Silver Price History Charts

Silver Price Libya

Libya is located in Northern Africa and has a land area of approximately 700,000 square miles. This makes LIbya the fourth largest African country and one of the largest in the world. Libya shares borders with Sudan, Chad, Niger, Egypt, Algeria and Tunisia. LIbya became an independent kingdom in the early 1950s, and remained that way until its king was overthrown in a 1969 coup. The leader of that coup, Muammar Gaddafi, took power in the country in 1973 and stayed in power until his death in 2011 during the Libyan Civil War. Libya has struggled to find stability since that time. The nation’s capital is Tripoli, home to about one million of the country’s approximate six million people.

The Libyan Dinar is the official currency of the country. The dinar was introduced in 1971, and can be subdivided into 1000 smaller units called dirham. Libya’s central bank, known as the Central Bank of Libya, is responsible for issuing and managing the country’s currency. LIke other global central banks, the central bank also has numerous other responsibilities including regulation of credit and oversight of the Libyan banking system.

If you are looking to buy silver in Libya or simply want to check current prices, you will likely see prices quoted in Libyan Dinar. Prices may also be quoted in other key global currencies such as euros, Japanese Yen, Great British Pounds or U.S. Dollars. Silver prices are usually quoted by the ounce, gram or kilo.

Libya has some of the largest oil reserves, and its economy is based on petroleum. In fact, petroleum products account for nearly all of the country’s export sales, and also make up a substantial portion of the country’s GDP. Libya’s oil reserves are the largest in Africa, and the nation is a member of OPEC.

Libya does not have any significant mining activity, and the nation has never been a big producer of silver coinage or bars. That being said, some Libyan silver collectible coins may be available. Collectible coins, however, may not be the best way to acquire a large amount of silver bullion. Collectible coins can have significantly higher premiums when compared to bullion coins, rounds or bars. Premiums on collectible coins are based on numerous factors that may include mint year, condition, total mintage, relative scarcity, market conditions and more.

For those looking to acquire as many total ounces of silver as possible, bullion bars, coins and rounds may provide a better overall value. Bars and rounds, in particular, may carry the lowest premiums allowing the purchaser to get more actual silver for their money. Silver bullion coins are considered good, legal tender by their issuing mint, and may carry higher premiums than bars or rounds. The best total value may potentially be had by purchasing cast bullion bars. Cast bars may be the least expensive for refiners to produce, and because of the way they are made no two cast bars will look exactly the same.