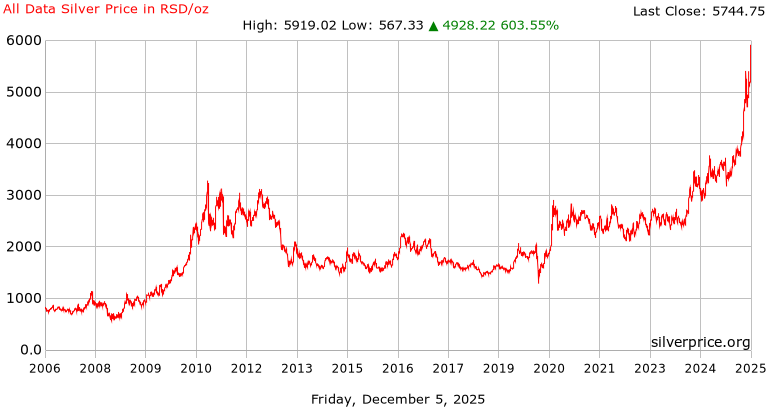

Silver Price Serbia

(Serbian Dinar)

Conversion : 1 troy ounce = 31.1034768 grams

Serbian Dinar 24 Hour Spot Silver Price

Serbian Dinar Silver Price History Charts

Silver Price Serbia

Serbia is known officially as the Republic of Serbia. The nation’s capital is the city of Belgrade, and the country has a population of approximately seven million. Belgrade is one of the oldest and largest cities in Southeastern Europe. The government of Serbia consists of a unitary parliamentary constitutional republic, and the nation’s official language is Serbian.

The official currency of Serbia is the Serbian Dinar. The dinar has a very long history, and numerous versions of the currency have come and gone. The earliest history of the Serbian Dinar dates all the way back to 1214. The modern version of the currency replaced the Yugoslav Dinar in 2003 at par. All dinar coins feature the same inscriptions and are available in several denominations including 1,2,5,10 and 20 dinari.

If you are looking to buy silver in Serbia, you will see spot silver prices quoted in dinar. Quotes may also be available in numerous other currencies as well, such as U.S. Dollars, euros, Great British Pounds or Japanese Yen. Silver is typically quoted by the ounce, gram or kilo, although other local units of measure may also be used.

The Serbian Dinar is issued and controlled by the country’s central bank, the National Bank of Serbia. The central bank was founded in 1884 and has numerous other key responsibilities in addition to managing the country’s currency. The central bank is headquartered in the capital city of Belgrade, and is tasked with maintenance of price stability and the nation’s financial system.

The economy of Serbia functions as a free market economy and is service-focused. The country is involved in numerous areas of industry including good processing, base metals, tires, pharmaceuticals, sugar and more. In addition to being the country’s capital, the city of Belgrade is also the nation’s financial and economic epicenter. The majority of both domestic and foreign companies that do business in Serbia center their operations in the capital.

Serbia has several natural resources including zinc, silver, chromite, magnesium, limestone, marble, iron ore and pyrite.

The country’s mining sector has been largely dormant for the last couple decades, although it could potentially see renewed interest as some believe that the country could be sitting on substantial deposits of several materials.

For investment purposes, silver can be purchased in various forms including bullion bars, coins, rounds and even jewelry. Bullion bars may potentially offer the most cost effective way to acquire the metal, as it typically carries the lowest overall premiums on a per-ounce basis.

Rounds may also offer a similarly reasonable premium over spot, but are typically only available in one ounce or fractional weights. Bullion coins may also be a great way to acquire the metal, but will typically come at a higher cost. Unlike rounds, coins are considered good, legal tender and are guaranteed by the issuing government mint.

As the nation’s economy expands, silver could potentially see increasing demand for both industrial and investment purposes.