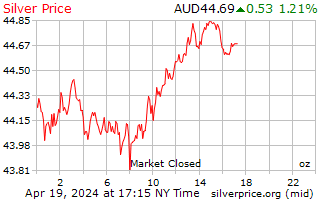

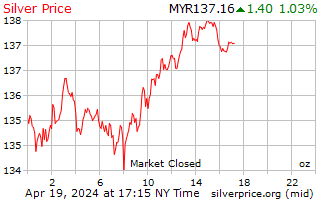

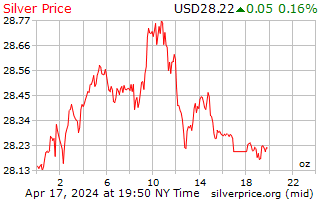

Silver Price per Ounce

On this page you will find silver prices per ounce. These silver prices depict the spot silver price, which is the price at which silver may be delivered on right now. The main chart also gives you the ability to view the current silver price per kilo instead of per ounce, and the current silver price in various currencies other than the U.S. Dollar.

You will also see a table that provides changes in the price of silver in dollars and cents as well as percentage points. For easy reference, the table lists these figures for today, 30 days, six months, one year, five year and 16 years. You can also set the table to view results using many different currencies.

How are Silver Prices Typically Quoted?

Silver is a dollar denominated commodity and its value is usually expressed as U.S. Dollars per ounce. You can also easily access silver prices in U.S. Dollars per kilogram. The prices that are quoted are known as the spot silver price.

The spot silver price is derived from futures contracts traded on an exchange such as COMEX. These exchange-traded contracts are for near-term delivery as well as delivery dates going very far out into the future. The current spot silver price is derived from a near-month contract that has the most trading activity.

What Drives Changes in the Silver Price?

Silver sees demand from two distinct sources: investment demand and industrial demand. Silver is widely used in modern industry, and it seems that more and more uses for the white metal are constantly being found. Some of the industrial arenas that silver is currently used in include:

-

Electronics

-

Chemical production

-

Healthcare

-

Solar energy production

-

Photography

-

X-ray film

As the potential uses for silver increase over time, rising demand for the metal could potentially drive prices higher. In addition, if the supply of silver becomes constrained, it could also possibly fuel higher prices.

Investment demand also plays a major role in the price of silver. Investors may seek to buy silver for numerous reasons. Some of the potential reasons may include:

-

The potential for price appreciation

-

To act as a hedge against inflation

-

To act as a hedge against declining currency values

-

For portfolio diversification

Silver coins, rounds and bars are very popular among both investors and collectors. Their relatively low cost compared to gold may make silver investments accessible to more investors.

Silver jewelry is also highly popular and may be purchased for both enjoyment and as an investment.

Silver prices per ounce remained below $10 per ounce during the 1980s, 90s and much of the early 2000s. The silver price per ounce began to climb around 2006, and over the next few years went from under $10 per ounce to around $20 per ounce in 2008. As the financial crises of 2008/2009 got underway, silver prices per ounce began to climb rapidly, eventually rising to nearly $50 per ounce in 2011. Silver prices eventually came back down, however, bottoming out in 2016 at less than $14 per ounce. The price of silver since that time has been oscillating between about $15 and $20 per ounce.

Silver prices per ounce are readily available in newspapers and online. Prices per ounce are in a constant state of flux as the laws of supply and demand fuel price volatility. Silver is traded all over the globe on numerous exchanges. Like other commodities, trading in silver never really ceases. As U.S. traders and investors are sleeping at night, other markets such as Asia may be seeing active buying and selling in silver.

Silver is typically bought for a premium over spot, and usually sold at a discount to spot. This is due to the fact that fabricators of silver coins, bars and rounds must not only pay for the silver content of their products, but must also pay for fabrication costs and a reasonable profit. Dealers also mark up silver in order to cover the costs of doing business and make a profit. Dealers will purchase silver from the public as well, but will typically pay less than the spot price. The difference, or spread, between the spot price and what a dealer pays or charges is known as the dealer spread. This spread allows a dealer to stay in business and potentially make a profit on transactions.