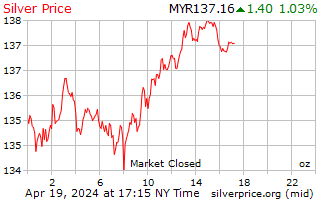

Silver Price Malaysia

(Malaysian Ringgits)

Conversion : 1 troy ounce = 31.1034768 grams

Malaysian Ringgits 24 Hour Spot Silver Price

Malaysian Ringgits Silver Price History Charts

Silver Price Malaysia

Located in Southeast Asia, the country of Malaysia has some of the world’s most diversified wildlife and the majority of the nation is covered by rainforest. Malaysia contains numerous states and territories, and the nation is broken up into two major sections of about equal size that are separated by the South China Sea: Peninsular Malaysia and East Malaysia. The country has a population of over 30 million, making it the 44th most populous country in the world. The capital of Malaysia is Kuala Lumpur, although the nation’s center of government is in the city of Putrajaya.

The Malaysian Ringgit is the official currency of Malaysia. Like many other global currencies, the ringgit can be subdivided into 100 smaller units of currency known as sen. The Malaysian Ringgit was introduced in 1967 by the central bank of the country, known as Bank Negara Malaysia. To prevent capital from leaving the nation, the ringgit became untradeable outside of Malaysia in 1998. Around that same time, the ringgit became pegged to the U.S. Dollar, a peg that would last until 2005. That year, China decided to remove the peg of its currency, the renminbi, to the U.S. Dollar and Malaysia followed suit shortly after. Once the ringgit/dollar peg was removed, the currency was allowed to operate in a managed float against several major currencies.

If you are looking to buy silver in Malaysia, or simply want to check current silver prices, you will likely see the metal quoted in the local currency. Prices for metals may also be available in numerous other key global currencies such as U.S. Dollars, Japanese Yen, euros or Great British Pounds. Prices are most often quoted by the ounce, gram or kilo.

The economy of Malaysia is around the 35th largest in the world. The nation is heavily involved in manufacturing, and is one the globe’s largest exporters of rubber. Some of the other main areas of industry include microchips, semiconductors, medical equipment, wood pulp, petrochemicals, electronics and semiconductors. The economy of Malaysia is a newly industrialized market economy, and it is highly robust and diversified.

Because Malaysia is so manufacturing-oriented, demand for silver and other metals could potentially increase significantly in the years and decades to come. Unlike gold which is bought primarily for investment purposes or jewelry, silver also derives strong demand from modern industry. The white metal is already used in a number of industrial arenas including solar energy production, electronics, chemical production and more.

In addition to industrial demand, the metal could also potentially see further investment demand in the region. As the Malaysian economy becomes more sophisticated, so too may its citizens when it comes to investment options. Like gold, silver has been considered a reliable store of wealth and value for centuries. The metal can potentially provide a hedge against economic issues like inflation or declining currency values, and also has the potential for significant price appreciation as demand rises.