Silver Price Sweden

(Swedish Krona)

Conversion : 1 troy ounce = 31.1034768 grams

Swedish Krona 24 Hour Spot Silver Price

Swedish Krona Silver Price History Charts

Silver Price Sweden

Sweden is officially known as the Kingdom of Sweden. Located in Northern Europe, Sweden is a Scandinavian country that borders Finland and Norway and is separated from Denmark by a bridge. Sweden has a land area of approximately 174,000 square miles, making it one of the largest countries in Europe. Because the nation is so big and only has a population of about 10 million, it has a very low population density. The capital of the country is Stockholm, and its official language is Swedish. The kingdom was first established in the 12th century, and its modern government is a unitary parliamentary constitutional monarchy.

The Swedish Krona is the country’s official currency. The krona is sometimes referred to as the Swedish Crown, and it has been Sweden’s official currency since 1873. The krona can be subdivided into 100 smaller units of currency, although cash transactions are now simply rounded to the nearest krona. At one point in its history, the krona operated on a gold standard.

The Swedish Krona is issued and controlled by the country’s central bank known as Sveriges Riksbank, or Riksbanken. Sweden’s central bank is the oldest central bank in the world, and is one of the oldest banks still in operation. The central bank is headquartered in the capital city of Stockholm, and was established in 1668. Sweden’s central bank has built a reputation for being one of the most innovative central banks anywhere in the world. The central bank is currently examining the use of an e-krona as the use of traditional cash declines.

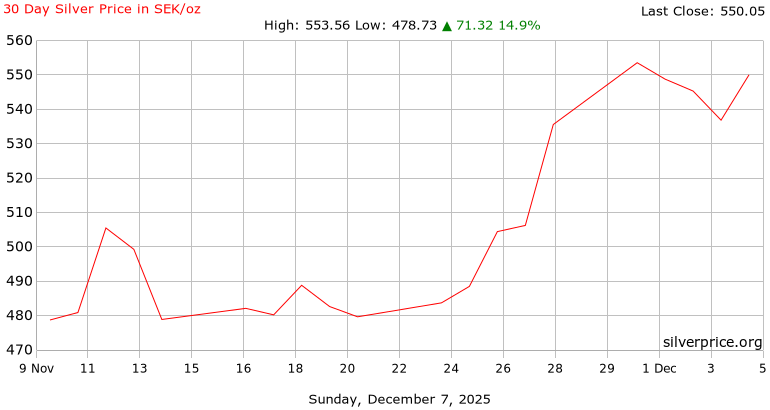

The price of silver in Sweden is quoted in the local currency. Quotes may also be available in other key global currencies such as Great British Pounds, euros, Japanese Yen or U.S. Dollars. The metal is typically quoted by the ounce, gram or kilo, although other local units of measure may also be used.

Although some fractional sizes may be available for certain products, the single ounce weight tends to be the most popular for silver bullion coins and rounds. Bullion bars, however, come in numerous weights as well and may offer the most cost effective way for investors to acquire more of the metal. While single ounce bars are very popular, larger weight bars like 5, 10 or even 10 ounce bars may potentially offer investors a lower total per-ounce premium.

The Swedish economy is export-oriented, with major export sales coming from machinery, wood and pulp, iron, steel, chemicals and more.

Sweden has a very generous universal welfare program that is financed through high tax revenues. The vast majority of the country’s companies and resources are privately owned with only a small portion being owned by the state.

Demand for the white metal in the nation could potentially expand in the years and decades ahead as more industrial uses are discovered for the metal. In addition, if the nation’s economy expands further, investment demand for the metal could also increase as investors seek out alternative choices to traditional asset classes like stocks and bonds.